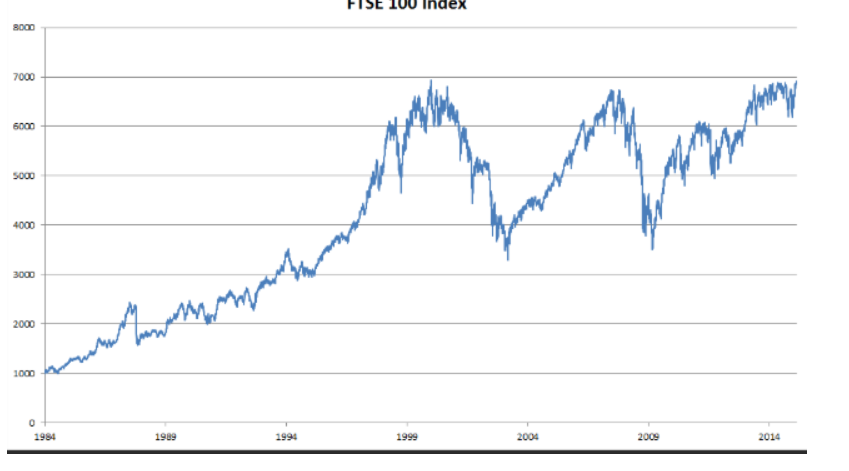

The FTSE 100, often referred to as the “Footsie,” is a share price index that tracks the performance of the 100 companies listed on the London Stock Exchange with the highest market capitalization.

As one of the most widely recognized indices in the financial world, it serves as a key benchmark for the overall performance of the UK stock market. Investors, analysts, and policymakers alike closely monitor the FTSE 100 to gain insight into the health of the economy, market trends, and the broader financial environment.

What Drives the FTSE 100?

Several factors influence the FTSE 100, making it a reflection of both global and domestic economic conditions, as well as the performance of individual companies. These include:

Global Economic Conditions:

The performance of the FTSE 100 is strongly influenced by global economic conditions. Economic growth, changes in interest rates, and geopolitical events can all have far-reaching effects on the index.

For example, when global economic growth is strong, the FTSE 100 tends to rise as companies in the index report higher earnings and increased demand for their products and services.

Conversely, during economic downturns or periods of uncertainty—such as a financial crisis or political instability—the index may decline due to reduced consumer confidence and investment.

Company Performance:

The individual performance of the 100 companies listed on the FTSE 100 directly impacts the index. If a significant number of these companies post strong earnings, high revenue growth, and promising future prospects, the FTSE 100 will generally rise.

On the other hand, poor earnings reports, a drop in revenue, or corporate scandals can cause the index to dip. Investors pay close attention to factors such as profitability, innovation, leadership, and market positioning when evaluating the companies within the FTSE 100.

Investor Sentiment:

Investor sentiment plays a pivotal role in the performance of the FTSE 100. The collective mood of investors—whether optimistic or pessimistic—can drive stock prices up or down, even in the absence of any major news or changes in company fundamentals.

Market sentiment is often influenced by broader factors such as political events, economic data releases, and shifts in global financial markets. For instance, a positive outlook for the UK economy can spur investor confidence, leading to a rally in the FTSE 100.

Currency Fluctuations:

As many FTSE 100 companies generate substantial revenue from overseas markets, fluctuations in the value of the pound sterling against other currencies can have a significant impact on their earnings.

A weaker pound can increase the earnings of these companies when converted back into sterling, potentially boosting stock prices. Conversely, a stronger pound may negatively affect the earnings of companies with significant international exposure. Given the global nature of the FTSE 100, currency fluctuations are an important consideration for investors.

Key Sectors in the FTSE 100

The FTSE 100 is a diverse index that includes companies from a wide range of sectors. Some of the key sectors within the index include:

Financials:

The financial sector is one of the largest and most influential within the FTSE 100. It encompasses a variety of companies, including banks, insurance companies, and asset managers. Major players in the sector, such as HSBC, Barclays, and Lloyds Banking Group, are often among the top contributors to the index’s performance. The health of the financial sector is crucial for the overall stability of the economy, and financial institutions play a vital role in driving economic growth.

Energy:

Oil and gas companies have traditionally been key components of the FTSE 100. The UK has historically been reliant on energy exports, and companies such as BP, Royal Dutch Shell, and others have had a significant presence in the index. The performance of the energy sector is often tied to global oil prices, which can fluctuate based on geopolitical factors, supply-demand imbalances, and environmental regulations.

Consumer Goods:

Companies involved in the production and distribution of consumer goods, such as food, beverages, clothing, and household products, are well-represented within the FTSE 100. Brands like Unilever, Diageo, and Tesco are among the most prominent in this sector. Consumer goods companies often serve as a bellwether for the health of the economy, as their performance is closely linked to consumer spending patterns and overall economic conditions.

Healthcare:

The healthcare sector is another important component of the FTSE 100, with pharmaceutical and biotechnology companies playing a leading role. Companies like GlaxoSmithKline and AstraZeneca are prominent in this sector, and their performance is often influenced by factors such as drug development, regulatory approval, and global health trends. The healthcare sector has gained increasing attention due to the growing global demand for medical treatments and innovations in biotechnology.

Mining:

The mining sector also holds significant weight in the FTSE 100, with UK-listed companies involved in the extraction of various minerals, including gold, copper, and iron ore. Mining companies such as BHP Group and Rio Tinto are key players in the global commodities market, and their stock prices are often influenced by the prices of metals and minerals on the global market.

How to Track the FTSE 100

Investors and financial enthusiasts can track the performance of the FTSE 100 using several resources:

Financial News Websites:

Leading financial news outlets, such as the Financial Times, Bloomberg, and Reuters, provide up-to-date information on the FTSE 100, including its current value, daily movements, and historical trends. These websites also feature in-depth analysis and commentary from market experts, offering insights into the factors driving changes in the index.

Online Brokerage Platforms:

Many online brokerage platforms offer real-time quotes and charts for the FTSE 100. These platforms provide investors with the tools they need to monitor the performance of the index, as well as individual stocks. Some platforms also offer advanced charting tools, which can be useful for identifying trends and making investment decisions.

Financial Data Providers:

Specialized financial data providers, such as Morningstar, provide comprehensive information on the FTSE 100. These providers offer detailed reports on individual companies, sector performance, and overall market trends. They also provide access to historical data, allowing investors to analyze long-term performance and make informed decisions.

The Importance of the FTSE 100 in the Global Economy

Beyond serving as a benchmark for the UK stock market, the FTSE 100 also plays a critical role in the global economy.

Given the international reach of many FTSE 100 companies, movements in the index can have ripple effects on global markets. Additionally, the performance of the FTSE 100 can provide valuable insights into the health of the UK economy and investor sentiment in the region.

Final Thought

The FTSE 100 is a vital indicator of the performance of the UK stock market, driven by various factors such as global economic conditions, company performance, investor sentiment, and currency fluctuations.

With its diverse range of sectors and companies, the index offers a snapshot of the UK economy’s broader health. Investors, analysts, and policymakers all turn to the FTSE 100 as a key tool for understanding market trends, making it an essential part of the financial landscape.

FAQs

Q: What is the current status of the FTSE 100 index today?

A: As of January 5, 2025, the FTSE 100 index closed at 8,223.98 points, marking a decline of 36.11 points (0.44%) from the previous day. The day’s trading saw a high of 8,268.97 and a low of 8,219.73. This performance reflects a slight downturn in the UK’s leading stock index.

Q: What factors influenced the FTSE 100’s performance today?

A: The FTSE 100’s performance was influenced by several factors. Energy stocks provided some support, with a 1% increase in this sector, as oil prices stabilized at a two-month high. Conversely, industrial metal miners faced challenges due to a stronger U.S. dollar, which negatively impacted the prices of basic metals. Additionally, the British Retail Consortium reported a 2.2% decline in store visitors in 2024, the largest drop since 2021, indicating a challenging year for retailers.

Q: How has the FTSE 100 performed over the past week?

A: Over the past week, the FTSE 100 has shown resilience, recording its second consecutive week of gains. Despite the slight decline on January 5, the index has demonstrated positive momentum in recent trading sessions.

Q: What are the recent trends in the UK stock market?

A: Recent trends in the UK stock market indicate a decline in enthusiasm and activity, particularly in the London stock market. In 2024, only 17 companies floated, raising £777 million, while 88 companies delisted. Retail investors have also withdrawn £25 billion from UK equity funds since 2021. This trend highlights challenges in market liquidity and investor confidence.

Q: How can I invest in the FTSE 100 index?

A: While it’s not possible to invest directly in the FTSE 100 index, investors can gain exposure through tracker funds and exchange-traded funds (ETFs) that aim to replicate the index’s performance. These investment vehicles are available through various financial institutions and platforms.

To read more, click here.